Managing vendor performance is critical to ensuring your business gets the best value and avoids supply chain disruptions. Here’s what you need to know:

- Vendor performance metrics track delivery, quality, cost, and compliance to evaluate supplier reliability.

- Companies with structured performance programs achieve 20% cost savings and 12% higher service levels.

- Key metrics include On-Time Delivery (OTD), defect rates, cost variance, SLA adherence, and invoice accuracy.

- Use vendor scorecards to consolidate metrics, assign weights, and track trends for actionable improvements.

- Automating performance tracking with tools like ERP systems minimizes errors and saves time.

Takeaway: Focus on 8–12 key metrics, apply consistent thresholds, and use scorecards to build stronger vendor relationships. Start small with critical suppliers and expand tracking as needed.

How To Establish Supplier Performance Metrics?

sbb-itb-e3aed85

Core Metrics and KPIs for Vendor Performance

Tracking the right metrics can turn vendor management into a precise, data-driven process. The metrics you prioritize should align with your operational goals - whether that's on-time deliveries, consistent quality, or cost management. Most organizations focus on three main areas: delivery, quality, and financial performance.

Delivery Metrics

Delivery metrics form the backbone of vendor performance evaluation. On-Time Delivery (OTD), a key metric, is calculated by dividing on-time orders by total orders and multiplying by 100. A rate below 95% signals a need for immediate action. Similarly, Order Accuracy, which measures how often vendors deliver the correct products, quantities, and destinations, is crucial to avoid disruptions and rework.

Lead Time Consistency is as important as the average lead time itself. A vendor delivering in 10 days on average but fluctuating between 5 and 20 days can wreak havoc on planning. To assess reliability, track both the average and the variance in lead times. For service vendors, the SLA Adherence Rate measures their ability to meet commitments like uptime or response times. Industry benchmarks for SLA adherence usually range between 95% and 99%, depending on the criticality of the service.

"Measuring vendor performance isn't the problem. Measuring the wrong things is." - Priyanshu Anand, TechnologyMatch

Another key metric, Order Capacity Fulfillment, ensures vendors can handle your volume demands, especially during peak seasons or scaling efforts. Standardizing definitions across departments - so terms like "on-time" mean the same to procurement, operations, and finance - is essential. To streamline accuracy, automate data collection through ERP or procurement software instead of relying on manual processes, which are prone to errors.

Once delivery performance is under control, quality metrics help ensure that what’s delivered meets your standards.

Quality Metrics

Quality metrics evaluate whether vendors consistently deliver on their promises. Defect Rate measures the percentage of products or services that fail to meet specifications, while Acceptance Rate tracks deliverables that pass quality standards. For physical goods, a defect rate above 2% often points to quality control issues.

For software and service vendors, SLA Compliance Rate is critical. This metric tracks breaches of contractual obligations, such as uptime guarantees. Most SaaS vendors aim for 99.9% uptime, which still allows for about 8.7 hours of downtime annually. For service delivery, distinguish between response time (acknowledgment) and resolution time - quick acknowledgments mean little if resolutions take too long.

Quality Audit Scores provide an objective assessment of compliance with internal or regulatory standards. For physical products, metrics like Return Rate and Warranty Claims can highlight long-term reliability issues that might not be immediately apparent. To prioritize metrics based on their business impact, use weighted scoring. For example, delivery might account for 40% of a scorecard in manufacturing but only 10% for professional services.

Set clear performance thresholds to avoid subjective debates: ≥95% is Green, 90–94% is Yellow, and <90% is Red. Share these performance trends with vendors during reviews to foster collaboration instead of finger-pointing. Tracking 3–6 months of data helps identify patterns, distinguishing isolated issues from ongoing problems.

While quality metrics verify the integrity of goods or services, financial metrics ensure you're getting the best value for your investment.

Financial and Efficiency Metrics

Financial metrics align vendor performance with your strategic goals, ensuring value beyond just the purchase price. Total Cost of Ownership (TCO) is a comprehensive measure that includes not only the purchase price but also costs like implementation, maintenance, and support. This reveals the true cost of working with a vendor. Cost Variance, calculated as the percentage difference between budgeted and actual costs, highlights whether a vendor is staying within scope. Variances exceeding 5–10% may indicate quoting errors or scope creep.

Invoice Accuracy is another critical metric, ensuring that billing aligns with agreed terms. Aim for ≥95% accuracy to minimize disputes and administrative overhead. Additionally, Price Competitiveness benchmarks vendor pricing against market rates to confirm you're getting fair value. Research shows that organizations with formal supplier performance programs achieve 20% better cost reductions compared to those without structured approaches.

Cost Savings Delivered quantifies financial benefits from negotiations or process improvements. Integrating spend data with KPIs can reveal opportunities for vendor consolidation and help catch "price creep" before it affects margins. For vendors accounting for 5–10% of your monthly expenses, conduct financial reviews monthly or quarterly. Lower-risk vendors can be reviewed less frequently without losing control.

| Financial KPI | Formula / Calculation | Target Benchmark |

|---|---|---|

| Cost Variance | ((Actual Cost - Budgeted Cost) / Budgeted Cost) × 100 | <5% to 10% |

| Invoice Accuracy | (Correct Invoices / Total Invoices) × 100 | ≥95% |

| TCO | Purchase Price + Implementation + Maintenance + Support | Vendor-specific baseline |

Automated tools can help flag duplicate suppliers, unmanaged contracts, or rising costs early. Also, include KPIs for vendor-led cost-saving initiatives to encourage suppliers to propose efficiencies that benefit both sides. Financial metrics help you distinguish between strategic partners who need close collaboration and transactional vendors who can be managed primarily for cost control.

Building and Using Vendor Scorecards

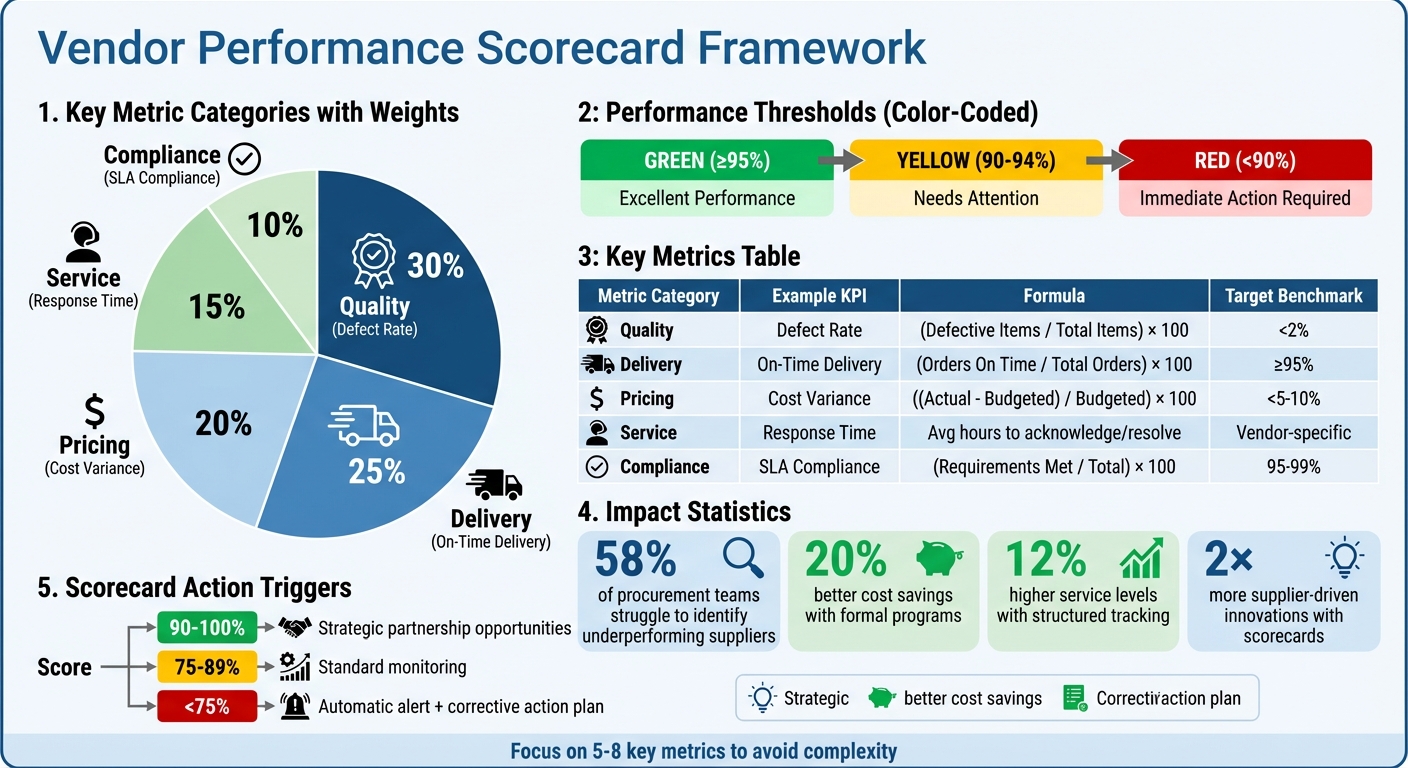

Vendor Performance Metrics Scorecard Framework with KPI Benchmarks

Vendor scorecards are a powerful tool for turning performance insights into actionable improvements. By consolidating key metrics into a unified framework, these scorecards replace guesswork with measurable, data-driven evaluations. This ensures consistent standards across teams and locations. Interestingly, 58% of procurement teams struggle to identify underperforming suppliers due to a lack of structured evaluation systems. A well-constructed scorecard bridges this gap effectively.

What Goes Into a Vendor Scorecard

A strong vendor scorecard includes three essential components: metrics, weights, and thresholds. Start by selecting 5–8 key metrics that reflect your business goals. Any more than that, and the scorecard risks becoming overly complex, leading to disengagement from stakeholders. Common metric categories include:

- Quality: Defect rates, error frequency

- Delivery: On-time delivery rates, lead time variance

- Cost: Price competitiveness, invoice accuracy

- Service: Response times, issue resolution

- Compliance: SLA adherence, regulatory requirements

Next, assign weights to each category based on what matters most to your organization. For instance, manufacturing firms might prioritize Quality at 40%, Delivery at 30%, Pricing at 20%, and Service at 10%. On the other hand, SaaS companies may focus on Security (35%), Reliability (30%), Support (20%), and Satisfaction (15%). These weights should align with your procurement strategy. For example, Delivery might account for 40% of the score for direct materials but only 10% for professional services.

"A successful organization's vendor scorecard is often a balanced scorecard that measures and tracks vendor performance on various levels related to organizational strategy."

- Gerard Blokdyk, CEO, The Art of Service

Choose a scoring scale that suits your reporting needs. Popular options include percentage scales (0–100), point systems, or letter grades (A–F). Define performance thresholds, such as ≥95% Green, 90–94% Yellow, <90% Red, to make evaluations clear and actionable.

To maintain credibility, ensure that at least 80% of your metrics are objective - quantifiable data is key. Pull data from sources like purchase orders, invoices, delivery receipts, and quality reports. Automating data entry through ERP integrations can reduce errors and save time.

| Metric Category | Standard Weight | Example KPI | Formula |

|---|---|---|---|

| Quality | 30% | Defect Rate | (Defective Items / Total Items) × 100 |

| Delivery | 25% | On-Time Delivery | (Orders Received On Time / Total Orders) × 100 |

| Pricing | 20% | Cost Variance | ((Actual Cost - Budgeted Cost) / Budgeted Cost) × 100 |

| Service | 15% | Response Time | Average hours to acknowledge/resolve tickets |

| Compliance | 10% | SLA Compliance | (SLA Requirements Met / Total Requirements) × 100 |

How to Use Scorecards

Vendor scorecards should do more than just collect data - they should drive meaningful action. Start by conducting quarterly reviews for high-risk or strategic vendors, while semi-annual reviews are usually sufficient for lower-risk partnerships. Share scorecard results transparently with vendors through portals or reports. This minimizes disputes over data accuracy and shifts the focus to collaborative problem-solving.

Use scorecards to track trends and compare performance across vendors in the same category. If a vendor's score falls below a threshold, such as 75%, this can trigger an automatic alert or corrective action plan. For underperforming vendors, implement a remediation plan that includes root cause analysis, corrective steps, and a clear timeline. Research shows that organizations with formal supplier performance programs experience 20% better cost outcomes and 12% higher service levels.

"The scorecard should act as an incentive, rather than a penalty, for suppliers."

- Suman Sarkar, Partner, 3S Consulting

Scorecards can also reward top performers. Vendors scoring 90–100% may earn strategic partnerships, expanded opportunities, or preferred payment terms. This taps into the Hawthorne Effect, where suppliers improve simply because they know they're being evaluated. In fact, formal scorecards can lead to twice as many supplier-driven innovations, helping drive progress.

Finally, update scorecard weights annually to reflect shifting priorities. For example, security and compliance might take precedence during regulatory audits, while cost may become the focus during economic challenges. Avoid overly complex metrics that require extensive manual data cleansing, as this delays updates and undermines trust. A simple, automated, and regularly updated scorecard is far more effective than a complicated one that sits unused.

Implementing Vendor Performance Tracking

Creating an effective vendor performance tracking system hinges on clear expectations, streamlined workflows, and consistent reviews. These elements ensure that insights from scorecards translate into actionable steps for better contract management.

Defining KPIs in Vendor Contracts

Collaborating with vendors to define performance metrics before signing a contract is crucial. This shared process ensures both sides agree on realistic targets and understand how success will be evaluated. While KPIs focus on broader goals like responsiveness or innovation, Service Level Agreements (SLAs) set specific, non-negotiable standards with remedies for non-compliance.

Contracts should prioritize measurable metrics - like percentages, costs, or time - over subjective evaluations, with at least 80% of the metrics being objective. For instance, if on-time delivery rates drop below 95%, immediate monitoring should kick in. Similarly, exceeding a 10% budget variance could highlight planning or control issues. The frequency of reporting should align with the vendor's risk level; critical vendors may need monthly reviews, while others might only require quarterly or annual assessments. It's also essential to include clear remediation strategies, detailing steps like root cause analysis, action plans, and deadlines. Companies with structured supplier performance management programs have reported better outcomes, including 20% higher cost savings and 12% improved service levels. Start by applying scorecards to the top 3–5 critical vendors, then expand the system to include all vendors. This approach helps align vendor performance with overarching business objectives.

Using Automated Tools

Relying on spreadsheets can lead to delays and errors. Automated platforms solve these issues by consolidating data from emails, invoices, and compliance logs into a single, reliable source. This integration links contracts, spending, and performance metrics in real time. By pulling data directly from work orders and service records, these tools minimize manual errors and save administrative time.

"Before Gatekeeper, our contracts were everywhere and nowhere."

- Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

Automation enables real-time monitoring with alerts for SLA breaches, quality issues, or certificate expirations, so teams can address problems before they escalate. For example, in 2025, BetterPlace, an HR technology company, achieved a 4× return on investment in just one month by using Spendflo for SaaS procurement and vendor management. Similarly, Advisor360° used Ramp’s vendor management software to centralize transactions, invoices, and contracts, significantly speeding up approvals. Ryan Williams, their Manager of Contract and Vendor Management, highlighted how this centralization provided instant access to vital information. Automated workflows can cut approval cycle times by 40–60%. Additionally, automated reminders for renewals help avoid unexpected auto-renewals, while AI insights can flag risks like duplicate suppliers or rising costs. To ensure fair comparisons, it’s important to standardize definitions across systems - metrics like "on-time delivery" or "defect rate" should be calculated consistently.

Conducting Regular Reviews

Automated tools provide real-time data, but regular reviews are key to maintaining accountability. The frequency of these reviews should match the vendor’s risk level. For critical vendors, monthly or quarterly reviews can focus on operational SLAs and incident trends, while lower-risk vendors might only need annual assessments.

Sharing performance data with vendors ahead of meetings gives them time to prepare explanations or feedback for missed targets. Effective review discussions should address three main points: successes, areas for improvement, and plans for the next quarter. Analyzing performance over 3–6 months, rather than relying on single-month snapshots, helps identify systemic issues versus temporary fluctuations.

Involving teams from procurement, finance, and operations ensures evaluations consider cost, quality, and operational impact. Documenting failed performance as "open issues" and requiring vendors to provide root cause analyses, action plans, and deadlines reinforces accountability. Assigning clear owners and deadlines for each action item further strengthens follow-through. Finally, linking spending to performance during reviews can uncover hidden problems, like price increases or duplicate contracts, that might erode margins even if service levels seem satisfactory.

Best Practices for SaaS Vendor Management

Balancing KPIs and KRIs

Managing SaaS vendors effectively means keeping an eye on KPIs (Key Performance Indicators) and KRIs (Key Risk Indicators). KPIs focus on how well vendors perform - think system uptime, response times, and service quality. On the other hand, KRIs highlight potential risks, like security breaches, compliance issues, or financial instability.

To strike the right balance, you need to track both types of metrics across five key areas: operational performance, financial performance, relationship quality, compliance and risk, and strategic value. For SaaS vendors, specific attention should go to metrics around data security, system uptime, and sensitive information protection. Instead of tracking dozens of metrics, focus on 8–12 that truly matter. This prevents data overload and ensures insights are actionable.

Setting clear thresholds for these metrics is also crucial. For instance, if system uptime dips below 99% or a security incident occurs, automated workflows should flag the issue for immediate review. Keep in mind that even a 99.9% uptime guarantee allows for roughly 8.7 hours of downtime annually - a significant risk for critical systems. Additionally, consider grouping vendors by their importance. High-risk or strategic vendors may need monthly reviews with detailed metrics, while less critical vendors can be reviewed less often.

Take UPL, for example. In 2025, this global agricultural solutions company centralized its supplier relationship management using the Ivalua platform. Under Sylesh Gopan's leadership, UPL achieved 100% PR-to-PO adoption in India by incorporating real-time budget checks and automated pricing compliance. This allowed them to scale globally while maintaining consistent vendor performance management.

"Relationships with strategic vendors are increasingly key to business performance. When managed badly, large strategic vendors can become complacent, slow moving and intractable." - Joanne Spencer, Senior Director Analyst, Gartner

Ultimately, while internal metrics are essential, selecting the right vendors starts with proper research and discovery.

Using SaaS Directories

Finding the right SaaS vendors begins with thorough research, and SaaS directories are a great place to start. Platforms like the All SaaS Software Directory (https://saassoftware.org) allow businesses to explore solutions across categories like billing, communication, design, ecommerce, and software development. These directories help organizations build vendor shortlists and conduct initial market surveys, making vendor management more data-driven.

A solid evaluation strategy involves multiple research layers. Start with curated directories to get a sense of the market, then consult peer review platforms for insights from companies in similar industries or of comparable size. This layered approach can save valuable time - especially given that the average mid-market company now uses over 130 different SaaS applications.

Before approving a vendor, check their security documentation through directories or trusted platforms. Look for certifications like SOC 2 or ISO 27001 and review their privacy policies. These directories can also help identify redundancies in your current stack. Sometimes, existing vendors may have added features that meet your needs, eliminating the need for new contracts. With 68% of business leaders prioritizing SaaS spend optimization, these tools are essential for making cost-effective, informed decisions.

Conclusion

Vendor performance metrics elevate basic transactions into meaningful partnerships that deliver measurable business results. Companies with structured supplier performance management programs see 20% better cost savings and 12% higher supplier service levels.

Switching from reactive crisis handling to a proactive approach is crucial. Nearly 42% of procurement leaders have faced at least one major supply chain disruption, with poor data management contributing to losses of up to $15 million annually and reducing profits by 62%.

To mitigate these risks, focus on these core strategies: prioritize 8–12 impactful metrics, apply the 80/20 rule to balance hard data with subjective insights, and treat performance reviews as opportunities for collaboration rather than blame. Start small, targeting your top 3–5 critical vendors, and gradually scale your efforts as your processes improve.

"What gets measured gets managed. And what gets managed well becomes a competitive advantage." - TechnologyMatch

FAQs

Which 8–12 vendor metrics should I track first?

To effectively monitor vendor performance, begin by evaluating essential metrics such as delivery time accuracy, order fulfillment accuracy, and quality scores. These indicators help measure reliability and ensure products meet standards. Additionally, track cost-related metrics like ROI and cost savings, alongside error rates, compliance rates, and customer satisfaction levels. Together, these metrics create a strong framework for minimizing risks, boosting efficiency, and building better vendor partnerships.

How do I set fair scorecard weights for different vendors?

To create balanced scorecard weights, start by assessing how each performance metric ties into your business goals. Metrics that directly impact critical areas, such as cost control or forecast accuracy, should carry more weight. Meanwhile, less impactful factors can be assigned lower weights. Begin with a preliminary evaluation: score vendors on the most important criteria, then fine-tune the weights to match their actual relevance. This approach helps maintain an objective and well-aligned evaluation process.

When should I trigger a corrective action plan?

When vendor performance issues - such as delays, quality concerns, or non-compliance - start to jeopardize your business operations or objectives, it’s time to implement a corrective action plan. Regularly track vendor performance using KPIs and scorecards to identify patterns of underperformance. If vendors consistently fall short of agreed-upon standards or fail to improve after receiving feedback, action is necessary.

Focus on addressing the root causes of these problems, ensuring clear communication with the vendor. Set measurable improvement targets to help bring their performance back in line with expectations.